Microsoft’s $68.7 billion bid to acquire video game maker Activision Blizzard has arrived in court. An evidentiary hearing that pits both tech giants against the Federal Trade Commission began at 8:30 A.M. Pacific (11:30 A.M. Eastern) on Thursday morning. Big money and an industry-wide restructuring are at stake over the corporate merger— which has stoked pushback globally. In the first few hours of the proceedings, a minor bombshell has already dropped—an unsealed email that could undermine the arguments of the merger’s main opponent, Sony.

The United Kingdom’s Competition and Markets Authority already rejected the deal in April, saying it would leave gamers with fewer options on the market. In contrast, the European Commission greenlit the buyout following a probe, though under the condition that Microsoft doesn’t keep Activision games from its competitors.

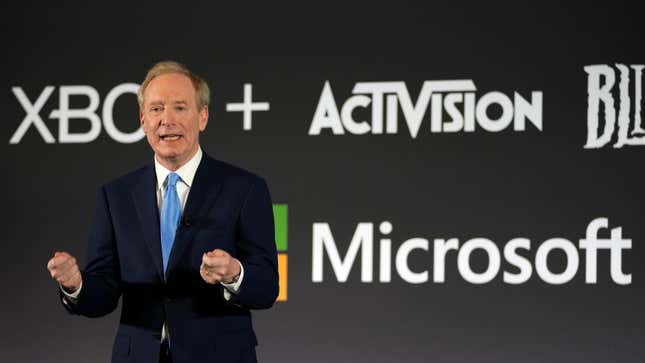

Now, in San Francisco federal court, Microsoft is working to convince Judge Jacqueline Scott Corley that its massive, nearly $70 billion purchase of the company behind Call of Duty, Overwatch, and World of Warcraft should be allowed to move forward. Over five days of proceedings, scheduled to conclude on June 29, both Activision Blizzard CEO Bobby Kotick and Microsoft CEO Satya Nadella are expected to testify. Meanwhile, the FTC is arguing that the proposed acquisition needs to be put on pause while regulators assess if the deal violates U.S. antitrust law.

The hearing precedes a trial set for August. Judge Corley’s ruling, following the hearing, will determine whether or not to grant the FTC’s request to stall the merger, until after that in-depth administrative trial. If Corley opts not to hold up the deal, it could be closed ahead of a July 18 deadline. If she decides the FTC’s preliminary injunction demand has legal merit, Microsoft might end up having to pay $3 billion in breakup fees to Activision Blizzard.

Opponents of the merger (primarily Sony) argue that it’s anticompetitive, and would give Microsoft (which owns Xbox) an unfair advantage by granting it ownership over some of the most popular video game titles on the market. Meanwhile proponents (namely Microsoft and Activision Blizzard) say the companies in opposition are doing so to defend their own profits and industry dominance.

Already, in the first hours of the hearing, at least one big revelation has dropped. In Microsoft’s opening statement, the company’s legal team summarized an unsealed email written by Sony’s PlayStation chief exec, Jim Ryan. That correspondence seems to contradict Sony’s primary line of opposition against the deal, according to reporting from The Verge. In an exchange with Sony’s CEO, Ryan wrote that he isn’t particularly concerned about Activision Blizzard games becoming Xbox exclusives under Microsoft. “It is not an exclusivity play at all,” said Ryan’s email, per The Verge. “I’m pretty sure we’ll continue to see Call of Duty on PlayStation for years to come.”

After opening statements, Xbox Game Studios leader Matt Booty took the stand, followed by Bethesda games exec, Peter Hines. The FTC’s lawyer questioned both on game deals amended post-acquisition to be Xbox only, according to Axios games reporter, Stephen Totilo.

More drama is sure to follow as the hearing moves forward, but—by the agency’s own account— the FTC faces an uphill battle to prove the vertical merger violates U.S. law. Similar efforts to take Meta to task over its acquisition of a VR fitness app earlier this year didn’t work out in the FTC’s favor. But Commission Chair Lina Khan, a noted critic of such mergers and an outspoken crusader against tech monopolies, is clearly willing to take on the fight.